Latest News

Stocks trading between $10 and $50 can be particularly interesting as they frequently represent businesses that have survived their early challenges.

However, investors should remain vigilant as some may still have unproven business models, leaving them vulnerable to the ebbs and flows of the broader market.

Via StockStory · January 18, 2026

Retailers are evolving to meet the expectations of modern, tech-savvy shoppers. One initiative that has helped the industry sustain its same-store sales growth is the expansion into e-commerce,

and retail stocks have been rewarded as they’ve returned 14.9% over the past six months and beat the S&P 500 by 4.8 percentage points.

Via StockStory · January 18, 2026

Wall Street has set ambitious price targets for the stocks in this article.

While this suggests attractive upside potential, it’s important to remain skeptical because analysts face institutional pressures that can sometimes lead to overly optimistic forecasts.

Via StockStory · January 18, 2026

Many small-cap stocks have limited Wall Street coverage, giving savvy investors the chance to act before everyone else catches on.

But the flip side is that these businesses have increased downside risk because they lack the scale and staying power of their larger competitors.

Via StockStory · January 18, 2026

Many small-cap stocks have limited Wall Street coverage, giving savvy investors the chance to act before everyone else catches on.

But the flip side is that these businesses have increased downside risk because they lack the scale and staying power of their larger competitors.

Via StockStory · January 18, 2026

Expensive stocks often command premium valuations because the market thinks their business models are exceptional.

However, the downside is that high expectations are already baked into their prices, leaving little room for error if they stumble even slightly.

Via StockStory · January 18, 2026

Market swings can be tough to stomach, and volatile stocks often experience exaggerated moves in both directions.

While many thrive during risk-on environments, many also struggle to maintain investor confidence when the ride gets bumpy.

Via StockStory · January 18, 2026

Mid-cap stocks often strike the right balance between having proven business models and market opportunities that can support $100 billion corporations.

However, they face intense competition from scaled industry giants and can be disrupted by new innovative players vying for a slice of the pie.

Via StockStory · January 18, 2026

Mid-cap stocks have the best odds of scaling into $100 billion corporations thanks to their tested business models and large addressable markets.

But the many opportunities in front of them attract significant competition, spanning from industry behemoths with seemingly infinite resources to small, nimble players with chips on their shoulders.

Via StockStory · January 18, 2026

Stocks trading between $10 and $50 can be particularly interesting as they frequently represent businesses that have survived their early challenges.

However, investors should remain vigilant as some may still have unproven business models, leaving them vulnerable to the ebbs and flows of the broader market.

Via StockStory · January 18, 2026

Small-cap stocks can be incredibly lucrative investments because their lack of analyst coverage leads to frequent mispricings.

However, these businesses (and their stock prices) often stay small because their subscale operations make it harder to expand their competitive moats.

Via StockStory · January 18, 2026

Small-cap stocks can be incredibly lucrative investments because their lack of analyst coverage leads to frequent mispricings.

However, these businesses (and their stock prices) often stay small because their subscale operations make it harder to expand their competitive moats.

Via StockStory · January 18, 2026

The $10-50 price range often includes mid-sized businesses with proven track records and plenty of growth runway ahead.

They also usually carry less risk than penny stocks, though they’re not immune to volatility as many lack the scale advantages of their larger peers.

Via StockStory · January 18, 2026

The performance of consumer discretionary businesses is closely linked to economic cycles. Over the past six months, it seems like demand may be facing some headwinds as the industry’s 7.5% return

has lagged the S&P 500 by 2.6 percentage points.

Via StockStory · January 18, 2026

The Russell 2000 (^RUT) is home to many small-cap stocks, offering investors the chance to uncover hidden gems before the broader market catches on.

However, these companies often come with higher volatility and risk, as their smaller size makes them more vulnerable to economic downturns.

Via StockStory · January 18, 2026

The Russell 2000 (^RUT) is home to many small-cap stocks, offering investors the chance to uncover hidden gems before the broader market catches on.

However, these companies often come with higher volatility and risk, as their smaller size makes them more vulnerable to economic downturns.

Via StockStory · January 18, 2026

Small-cap stocks in the Russell 2000 (^RUT) can be a goldmine for investors looking beyond the usual large-cap names.

But with less stability and fewer resources than their bigger counterparts, these companies face steeper challenges in scaling their businesses.

Via StockStory · January 18, 2026

Elon Musk has confirmed he hasn't sold any Tesla shares in the past 3 years and has invested in buying more.

Via Benzinga · January 18, 2026

Investor Steve Eisman said that President Donald Trump's push to lower mortgage costs could ignite a sharp, short-term rally in these U.S. homebuilder stocks, even if the policies don't solve the market's deeper problems.

Via Benzinga · January 18, 2026

Elon Musk said Tesla is restarting its Dojo3 supercomputer project after progress on the AI5 chip, while calling on top engineers to help build high-volume chips that will power the company's AI and self-driving ambitions.

Via Benzinga · January 18, 2026

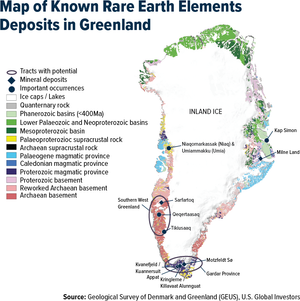

Greenland ranks eighth globally in proven rare earth metals, with the potential to move even higher as exploration advances. Only 5 mining companies operate there and they are all up substantially YTD.

Via Talk Markets · January 18, 2026

Both the price of silver and the silver-to-gold price ratio have risen in accordance with my analysis.

Via Talk Markets · January 18, 2026

A high-speed train collision in Spain on Malaga-to-Madrid route near Adamuz has left 21 dead and over 75 injured

Via Benzinga · January 18, 2026

It's an expense that could easily bust your retirement budget.

Via The Motley Fool · January 18, 2026

What a brutal six months it’s been for Integer Holdings. The stock has dropped 23.1% and now trades at $85.78, rattling many shareholders. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Via StockStory · January 18, 2026

The past six months have been a windfall for Semtech’s shareholders. The company’s stock price has jumped 46.5%, hitting $77.73 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Via StockStory · January 18, 2026

Over the last six months, ZoomInfo’s shares have sunk to $9.02, producing a disappointing 14.4% loss - a stark contrast to the S&P 500’s 10.1% gain. This might have investors contemplating their next move.

Via StockStory · January 18, 2026

Sinclair has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 5.7% to $15.25 per share while the index has gained 10.1%.

Via StockStory · January 18, 2026

Amazon currently trades at $238.80 per share and has shown little upside over the past six months, posting a middling return of 4.1%. The stock also fell short of the S&P 500’s 10.1% gain during that period.

Via StockStory · January 18, 2026

C3.ai has gotten torched over the last six months - since July 2025, its stock price has dropped 53.8% to $13.09 per share. This may have investors wondering how to approach the situation.

Via StockStory · January 18, 2026

Since January 2021, the S&P 500 has delivered a total return of 82.8%. But one standout stock has more than doubled the market - over the past five years, HCA Healthcare has surged 183% to $470.79 per share. Its momentum hasn’t stopped as it’s also gained 29.1% in the last six months thanks to its solid quarterly results, beating the S&P by 19%.

Via StockStory · January 18, 2026

SolarEdge’s 17.6% return over the past six months has outpaced the S&P 500 by 7.5%, and its stock price has climbed to $33.91 per share. This run-up might have investors contemplating their next move.

Via StockStory · January 18, 2026

Over the past six months, Carlisle’s shares (currently trading at $363.80) have posted a disappointing 10.2% loss, well below the S&P 500’s 10.1% gain. This may have investors wondering how to approach the situation.

Via StockStory · January 18, 2026

Varonis Systems’s stock price has taken a beating over the past six months, shedding 35.7% of its value and falling to $33.55 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Via StockStory · January 18, 2026

Cable One has gotten torched over the last six months - since July 2025, its stock price has dropped 38% to $87 per share. This may have investors wondering how to approach the situation.

Via StockStory · January 18, 2026

Tron founder Justin Sun said on Sunday, January 18, he'd pay $30 million for a single hour of private conversation with Elon Musk, in what looked like his admiration for the tech mogul.

Via Benzinga · January 18, 2026

UiPath and IBM could be better bets.

Via The Motley Fool · January 18, 2026

Economist Peter Schiff has pushed back against President Donald Trump's claims regarding the United States being the benefactor of global trade, arguing that it was, in fact, its biggest beneficiary.

Via Benzinga · January 18, 2026

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Jamf (NASDAQ:JAMF) and the rest of the automation software stocks fared in Q3.

Via StockStory · January 18, 2026

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Papa John's (NASDAQ:PZZA) and the best and worst performers in the traditional fast food industry.

Via StockStory · January 18, 2026

As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the engineering and design services industry, including AECOM (NYSE:ACM) and its peers.

Via StockStory · January 18, 2026

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the gas and liquid handling stocks, including Graco (NYSE:GGG) and its peers.

Via StockStory · January 18, 2026

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Health Catalyst (NASDAQ:HCAT) and the best and worst performers in the data analytics industry.

Via StockStory · January 18, 2026

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at processors and graphics chips stocks, starting with Allegro MicroSystems (NASDAQ:ALGM).

Via StockStory · January 18, 2026

Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at RenaissanceRe (NYSE:RNR) and its peers.

Via StockStory · January 18, 2026

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how ground transportation stocks fared in Q3, starting with Covenant Logistics (NYSE:CVLG).

Via StockStory · January 18, 2026

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Bentley Systems (NASDAQ:BSY) and the best and worst performers in the vertical software industry.

Via StockStory · January 18, 2026

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Yum! Brands (NYSE:YUM) and the rest of the traditional fast food stocks fared in Q3.

Via StockStory · January 18, 2026

As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the defense contractors industry, including Lockheed Martin (NYSE:LMT) and its peers.

Via StockStory · January 18, 2026

Wrapping up Q3 earnings, we look at the numbers and key takeaways for the apparel and accessories stocks, including Carter's (NYSE:CRI) and its peers.

Via StockStory · January 18, 2026