Recent Articles from The Motley Fool

The Motley Fool, founded in 1993 by brothers David and Tom Gardner, is a multimedia financial services company dedicated to empowering individual investors with accessible, actionable advice. Headquartered in Alexandria, Virginia, the company offers a range of products, including stock recommendations, investment research, and personal finance guidance, through its popular website, newsletters, podcasts, and premium subscription services.

Website: https://www.fool.com

Bargains can still be found, even amid a historically pricey stock market.

Via The Motley Fool · January 29, 2026

Palantir Technologies is a cornerstone of the artificial intelligence trade.

Via The Motley Fool · January 29, 2026

Bitcoin and XRP look like they are built to stand the test of time.

Via The Motley Fool · January 29, 2026

Viking Global Investors' billionaire boss sent shares of two trillion-dollar club members to the chopping block and made another of the stock market's largest companies a top-five holding.

Via The Motley Fool · January 29, 2026

This streaming giant has fallen, but looks ready for a ferocious rebound.

Via The Motley Fool · January 29, 2026

These companies offer high-yielding and steadily rising income streams.

Via The Motley Fool · January 29, 2026

Make sure these changes are on your radar.

Via The Motley Fool · January 29, 2026

Netflix stock has plummeted nearly 30% over the last six months.

Via The Motley Fool · January 29, 2026

Some investors are avoiding Palantir due to its pricey valuation. It could be a costly mistake.

Via The Motley Fool · January 29, 2026

If you're an income investor, the great news for UPS is probably all that will matter.

Via The Motley Fool · January 29, 2026

Tuesday's sell-off in UnitedHealth Group's stock was arguably overdone.

Via The Motley Fool · January 29, 2026

Costco has generated fantastic growth over the years, and it can also be an attractive option for dividend investors.

Via The Motley Fool · January 29, 2026

The expected results are impressive. Most investors are just too focused on its recent past.

Via The Motley Fool · January 29, 2026

This could be the better route for millions of couples.

Via The Motley Fool · January 29, 2026

CoreWeave has built a compelling AI cloud product despite the stiff competition in the space.

Via The Motley Fool · January 29, 2026

Before you pack up and move for seemingly greener pastures, there's something else you might want to consider.

Via The Motley Fool · January 29, 2026

Peter Cannito is the chairman and CEO of Redwire, a space infrastructure and services company.

Via The Motley Fool · January 29, 2026

Silver prices are blasting higher as demand far outpaces supply, and First Majestic is one company that could ride this wave higher.

Via The Motley Fool · January 29, 2026

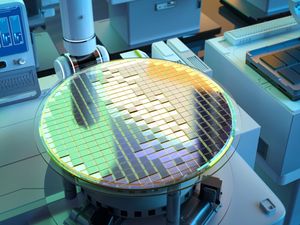

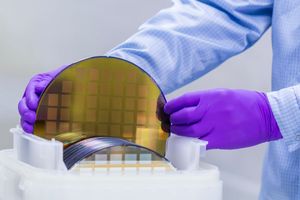

Advanced Micro Devices has numerous catalysts in 2026.

Via The Motley Fool · January 29, 2026

Is China about to allow its tech companies to purchase Nvidia AI chips?

Via The Motley Fool · January 29, 2026

BigBear.ai's stock is off to a strong start in 2026.

Via The Motley Fool · January 29, 2026

The tech giant will soon provide shareholders with its Q4 2025 financial results.

Via The Motley Fool · January 29, 2026

The Technology Select Sector SPDR Fund spreads exposure across tech, while the Roundhill Generative AI and Technology ETF concentrates it around AI. This ETF comparison shows why that difference matters when AI valuations come under pressure.

Via The Motley Fool · January 29, 2026

Japan's stock market reached all-time highs in 2026 because of some simple regulatory changes behind the scenes.

Via The Motley Fool · January 28, 2026

Intel stock has been surging of late, but the business is still well behind this manufacturing leader.

Via The Motley Fool · January 28, 2026

Texas Instruments posted a technical earnings miss. Investors shrugged and bought the stock anyway.

Via The Motley Fool · January 28, 2026

Remitly has delivered strong growth since its IPO, but the stock has fallen.

Via The Motley Fool · January 28, 2026

The wireless leader's shareholders have over $45 billion in dividends and stock buybacks headed their way.

Via The Motley Fool · January 28, 2026

High dividend yields are often a sign of trouble, which makes Enbridge's 5.6% yield very interesting.

Via The Motley Fool · January 28, 2026

Fair Isaac (FICO) Q1 2026 Earnings Call Transcript

Via The Motley Fool · January 28, 2026

The key to a successful retirement is building a portfolio that provides sustained purchasing power.

Via The Motley Fool · January 28, 2026

Bitcoin Hasn't Had a Bad Day Yet in 2026. Is the Leading Crypto Set to Bounce Back in 2026?fool.com

The world's top cryptocurrency could finally warm up this year.

Via The Motley Fool · January 28, 2026

Buying and holding businesses with solid revenue and earnings gains can be a winning strategy.

Via The Motley Fool · January 28, 2026

It might take a while for this AI company to prove its worth, if it ever does so.

Via The Motley Fool · January 28, 2026

This forgotten pandemic stock hasn't said its last word.

Via The Motley Fool · January 28, 2026

Amgen may not have an approved GLP-1 treatment just yet, but that could change in the future.

Via The Motley Fool · January 28, 2026

Levi Strauss (LEVI) Q4 2025 Earnings Transcript

Via The Motley Fool · January 28, 2026

The artificial intelligence (AI) boom is creating an insatiable need for advanced data management solutions.

Via The Motley Fool · January 28, 2026

Raymond James (RJF) Q1 2026 Earnings Transcript

Via The Motley Fool · January 28, 2026

Deluxe (DLX) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 28, 2026

ServiceNow (NOW) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 28, 2026

Las Vegas Sands (LVS) Q4 2025 Earnings Transcript

Via The Motley Fool · January 28, 2026

The number of picks that you know are Buffett-approved is only going to shrink from here. Act now while you can.

Via The Motley Fool · January 28, 2026

You'll be surprised at how this stock has performed over the past year.

Via The Motley Fool · January 28, 2026

Flowserve provides engineered flow management equipment and services to global infrastructure and industrial markets.

Via The Motley Fool · January 28, 2026

Intel has a lot of proving to do after issuing disappointing guidance.

Via The Motley Fool · January 28, 2026

Bitcoin's meteoric rise has delivered huge returns for holders. Even small investments have turned into tens of thousands of dollars.

Via The Motley Fool · January 28, 2026

The company's high-profile competitor just posted highly encouraging results for its latest quarter.

Via The Motley Fool · January 28, 2026

Investors don't need to worry about this oil major's sterling dividend track record or its future.

Via The Motley Fool · January 28, 2026

Investors weren't happy with the company's profitability guidance for the full year.

Via The Motley Fool · January 28, 2026

After a years-long revenue drought, there's a light at the end of the tunnel.

Via The Motley Fool · January 28, 2026

C.H. Robinson (CHRW) Q4 2025 Earnings Transcript

Via The Motley Fool · January 28, 2026

Tesla (TSLA) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 28, 2026

Rivian is on the cusp of an important achievement that will help determine the company's long-term future as a business.

Via The Motley Fool · January 28, 2026

Microsoft (MSFT) Q2 2026 Earnings Call Transcript

Via The Motley Fool · January 28, 2026

The company's recent performance wasn't as bad as some had feared.

Via The Motley Fool · January 28, 2026

We knew Meta's full-year capital expenditure forecast would exceed $100 billion; we just didn't know the exact range. Now we have it.

Via The Motley Fool · January 28, 2026

Berkshire Hathaway's next earnings update will be the first under Greg Abel's leadership.

Via The Motley Fool · January 28, 2026

IBM (IBM) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 28, 2026

Lam Research LRCX Q2 2026 Earnings Call Transcript

Via The Motley Fool · January 28, 2026

These top brands are not on the same track.

Via The Motley Fool · January 28, 2026

LendingClub (LC) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 28, 2026

The social media giant continues to fire on all cylinders.

Via The Motley Fool · January 28, 2026

Broadcom is an easy way to profit from the secular expansion of the AI market.

Via The Motley Fool · January 28, 2026

MSCI (MSCI) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 28, 2026

The chipmaker remains a top play in the booming AI infrastructure market.

Via The Motley Fool · January 28, 2026

Badger Meter (BMI) Q4 2025 Earnings Transcript

Via The Motley Fool · January 28, 2026

Morningstar delivers independent investment research and financial data solutions to professionals and institutions worldwide.

Via The Motley Fool · January 28, 2026

It's been stunning watching just how much this fitness tech innovator has fallen out of favor.

Via The Motley Fool · January 28, 2026

GE Vernova GEV Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 28, 2026

SEI Investments (SEIC) Q4 2025 Earnings Transcript

Via The Motley Fool · January 28, 2026

Meta (META) Q4 2025 Earnings Call Transcript

Via The Motley Fool · January 28, 2026

Is Polkadot ready for the web3 era?

Via The Motley Fool · January 28, 2026

Houlihan Lokey HLI Q3 2026 Earnings Transcript

Via The Motley Fool · January 28, 2026

The company beat analysts' Q4 2025 expectations, but it's the company's 2026 expectations that also has investors excited.

Via The Motley Fool · January 28, 2026