News

Explore how LQD’s broader bond mix and TLT’s Treasury focus shape risk, yield, and diversification for fixed income portfolios.

Via The Motley Fool · March 4, 2026

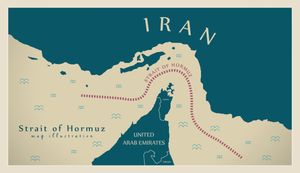

Is the Iran war a reason to change your investing strategy?

Via The Motley Fool · March 4, 2026

The original exchange-traded fund is still hugely popular.

Via The Motley Fool · March 4, 2026

Noble, a former associate of Fidelity’s Peter Lynch, said on Wednesday in a social media post that energy stocks were a good bet even before the geopolitical disruption from the ongoing war in Iran.

Via Stocktwits · March 4, 2026

The company also stated that it plans to introduce tokenized stocks in the future.

Via Stocktwits · March 4, 2026

According to a report from Reuters, the investment bank has said that it sees the correction risks in the market as a buying opportunity.

Via Stocktwits · March 4, 2026

Here's how to get exposure to thousands of stocks with a click of a button.

Via The Motley Fool · March 4, 2026

Bitcoin price pushed to month-high as ETF flows rebounded. Trump blamed banks for legislative delays. ARK buys these crypto stocks.

Via Investor's Business Daily · March 4, 2026

A simple low cost, two-ETF strategy would have beaten the vast majority of active managers over the past decade.

Via The Motley Fool · March 4, 2026

As of March 4, 2026, the American financial landscape is undergoing a tectonic shift, driven by the implementation of the "One Big Beautiful Act" (OBBBA). Signed into law on July 4, 2025, this sweeping tax reform has effectively dismantled the "sunset" anxiety that plagued corporate boardrooms for years. By restoring

Via MarketMinute · March 4, 2026

His latest purchase is an interesting way to invest in the booming memory chip market.

Via The Motley Fool · March 4, 2026

CHICAGO — The silver market has entered a period of extreme volatility as the March 2026 COMEX delivery season begins, fueled by a precarious imbalance between physical supply and paper demand. As of March 4, 2026, market participants are closely monitoring the CME Group (Nasdaq: CME) and its ability to facilitate

Via MarketMinute · March 4, 2026

Software company stocks have been getting hammered due to fears that artificial intelligence will disrupt their business models.

Via The Motley Fool · March 4, 2026

The precious metals market witnessed a day of intense turbulence on March 4, 2026, as a delayed wave of selling pressure finally hit domestic investment vehicles. Following a brutal global bullion rout on March 3, Indian-listed silver exchange-traded funds (ETFs) experienced a "catch-up" correction, plunging more than 7% in early

Via MarketMinute · March 4, 2026

According to Palihapitiya, Bitcoin's public ledger is hard to keep private because it is accessible to all.

Via Stocktwits · March 4, 2026

The Cashtag Awards celebrate the people and products shaping the future of trading and investing.

Via Stocktwits · March 4, 2026

Regional banks are an interesting subcategory of the finance industry, but investors need to tread carefully.

Via The Motley Fool · March 4, 2026

Goldman Sachs warns Brent crude could reach $100 if Strait of Hormuz disruptions persist, tightening inventories and boosting oil ETFs like USO.

Via Benzinga · March 4, 2026

Microchip Technology is outshining the technology sector lately, and analysts remain highly optimistic about the stock’s outlook.

Via Barchart.com · March 4, 2026

MetLife has underperformed other insurance stocks over the past year, but analysts remain somewhat optimistic about the stock’s growth potential.

Via Barchart.com · March 4, 2026

Valero Energy has outperformed the S&P 500 over the past year, and analysts remain moderately optimistic about the stock’s growth potential.

Via Barchart.com · March 4, 2026

Bitcoin surged to $71,000 on improving market sentiment, with liquidations at $417.92 million over the past 24 hours. Bitcoin ETFs saw $225.2 million in net inflows on Tuesday, while Ethereum ETFs reported $10.8 million in net outflows.

Via Benzinga · March 4, 2026

Despite the choices that ETF investors have nowadays, you can literally get all the global stock and bond exposure you'd ever need with just a pair of Vanguard ETFs.

Via The Motley Fool · March 4, 2026

You might be surprised at how your money is allocated once you invest.

Via The Motley Fool · March 4, 2026

These ETFs are ideal long-term holdings.

Via The Motley Fool · March 4, 2026