Freeport-McMoRan (FCX)

60.23

-4.90 (-7.52%)

NYSE · Last Trade: Feb 1st, 8:29 AM EST

The global precious metals market suffered its most violent "flash crash" in recent history today, January 30, 2026, as a "perfect storm" of hawkish U.S. monetary policy signals and massive technical liquidations erased months of gains in a matter of hours. Gold prices, which had reached a staggering peak

Via MarketMinute · January 30, 2026

Explore the top gainers and losers within the S&P500 index in today's session.chartmill.com

Via Chartmill · January 30, 2026

These S&P500 stocks are the most active in today's sessionchartmill.com

Via Chartmill · January 30, 2026

In a move that has sent shockwaves through global financial markets, President Donald Trump has officially nominated Kevin Warsh to succeed Jerome Powell as the next Chairman of the Federal Reserve. The announcement, made on the morning of January 30, 2026, marks the culmination of a year-long campaign by the

Via MarketMinute · January 30, 2026

What's going on in today's pre-market session: S&P500 moverschartmill.com

Via Chartmill · January 26, 2026

What's going on in today's session: S&P500 moverschartmill.com

Via Chartmill · January 30, 2026

The global mining industry is bracing for a seismic shift as the February 5 deadline approaches for Rio Tinto (NYSE: RIO) to finalize its pursuit of Glencore (LSE: GLEN). This high-stakes corporate drama intensified this week following Glencore's release of its 2025 production results, which revealed a sharp 11% decline

Via MarketMinute · January 30, 2026

Which S&P500 stocks are gapping on Friday?chartmill.com

Via Chartmill · January 30, 2026

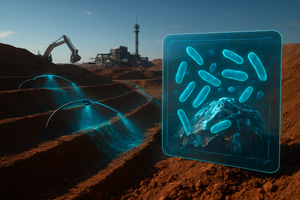

Investors are excited about the recent spike in copper prices.

Via The Motley Fool · January 30, 2026

These S&P500 stocks that are showing activity before the opening bell on Friday.chartmill.com

Via Chartmill · January 30, 2026

Veteran commodities analyst Ole Hansen of Saxo Bank highlighted multiple near-term supply and demand signals that don’t fully justify the rally.

Via Stocktwits · January 29, 2026

These S&P500 stocks have an unusual volume in today's sessionchartmill.com

Via Chartmill · January 29, 2026

These S&P500 stocks that are showing activity before the opening bell on Thursday.chartmill.com

Via Chartmill · January 29, 2026

Via MarketBeat · January 29, 2026

Copper is a key part of data center infrastructure necessary to support booming artificial intelligence (AI) growth.

Via The Motley Fool · January 29, 2026

Via MarketBeat · January 27, 2026

The global copper market has entered a transformative era, driven by a "perfect storm" of surging demand from artificial intelligence (AI) data centers and a series of catastrophic supply shocks at major traditional mines. As of late January 2026, copper prices have stabilized near a historic $5.91 per pound,

Via MarketMinute · January 27, 2026

As the first month of 2026 draws to a close, the financial landscape is witnessing a profound structural shift that many analysts are calling the 'Great Rotation.' After years of dominance by Silicon Valley and the banking elite, the pendulum of investor sentiment has swung back toward the tangible

Via MarketMinute · January 26, 2026

What's going on in today's session: S&P500 most active stockschartmill.com

Via Chartmill · January 26, 2026

Discover which S&P500 stocks are making waves on Monday.chartmill.com

Via Chartmill · January 26, 2026

Exploring the top movers within the S&P500 index during today's session.chartmill.com

Via Chartmill · January 23, 2026

As the first month of 2026 unfolds, a dramatic shift in market leadership is reshaping investor portfolios. For years, the dominant narrative was the unstoppable ascent of mega-cap technology, but by January 23, 2026, that story has encountered a significant rewrite. Investors are aggressively rotating out of high-flying AI and

Via MarketMinute · January 23, 2026

Which S&P500 stocks are moving before the opening bell on Friday?chartmill.com

Via Chartmill · January 23, 2026

Freeport-McMoRan (FCX) Q4 2025 Earnings Transcript

Via The Motley Fool · January 22, 2026