Clorox’s stock price has taken a beating over the past six months, shedding 21.7% of its value and falling to $130.88 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Following the pullback, is now the time to buy CLX? Find out in our full research report, it’s free.

Why Does Clorox Spark Debate?

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE:CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

Two Positive Attributes:

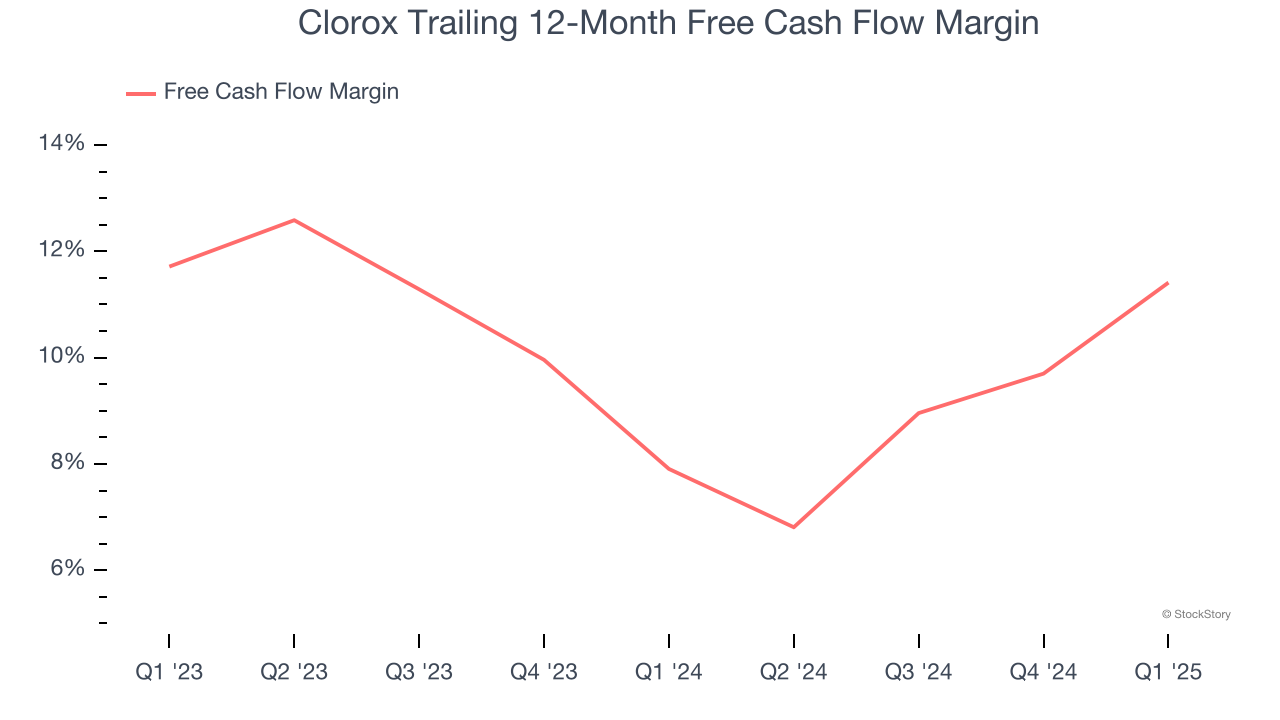

1. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Clorox’s margin expanded by 3.5 percentage points over the last year. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Clorox’s free cash flow margin for the trailing 12 months was 11.4%.

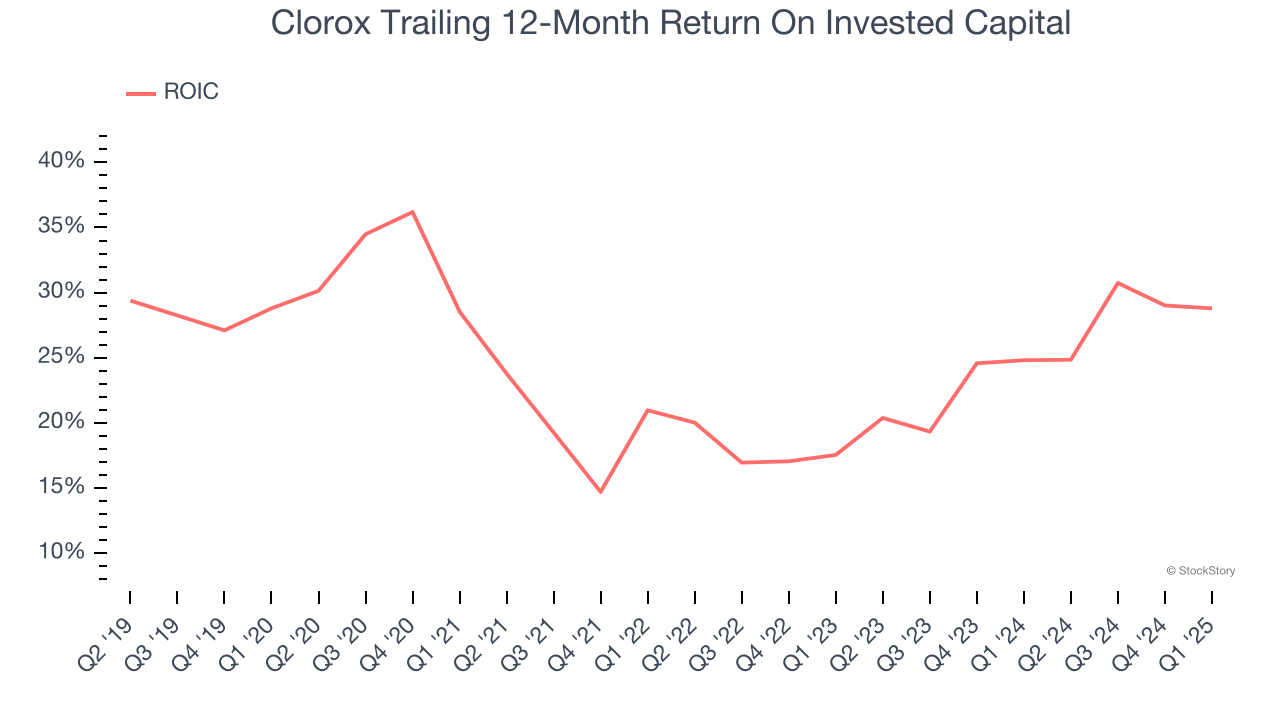

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Clorox’s five-year average ROIC was 24.1%, beating other consumer staples companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

One Reason to be Careful:

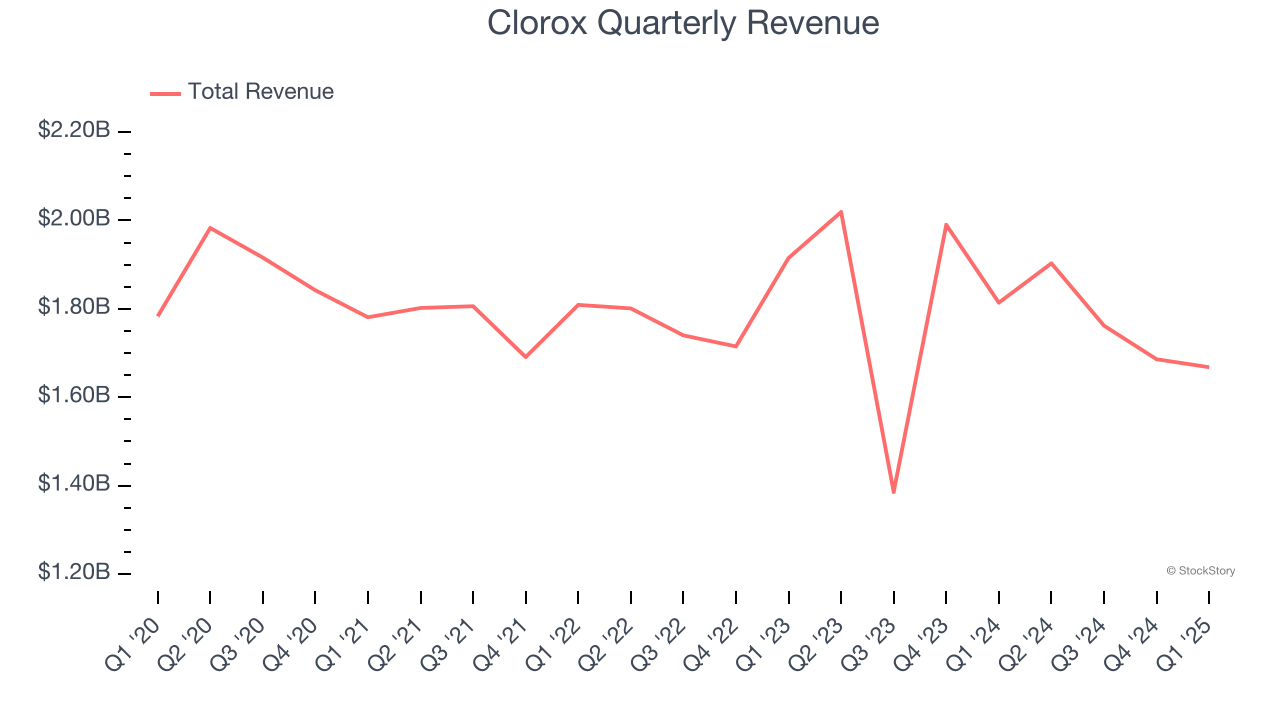

Long-Term Revenue Growth Flatter Than a Pancake

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Clorox struggled to consistently increase demand as its $7.02 billion of sales for the trailing 12 months was close to its revenue three years ago. This wasn’t a great result, but there are still things to like about Clorox.

Final Judgment

Clorox’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 18× forward P/E (or $130.88 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Clorox

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.