Skyworks Solutions trades at $73 and has moved in lockstep with the market. Its shares have returned 30.4% over the last six months while the S&P 500 has gained 25.5%.

Is there a buying opportunity in Skyworks Solutions, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think Skyworks Solutions Will Underperform?

We're swiping left on Skyworks Solutions for now. Here are three reasons there are better opportunities than SWKS and a stock we'd rather own.

1. Revenue Tumbling Downwards

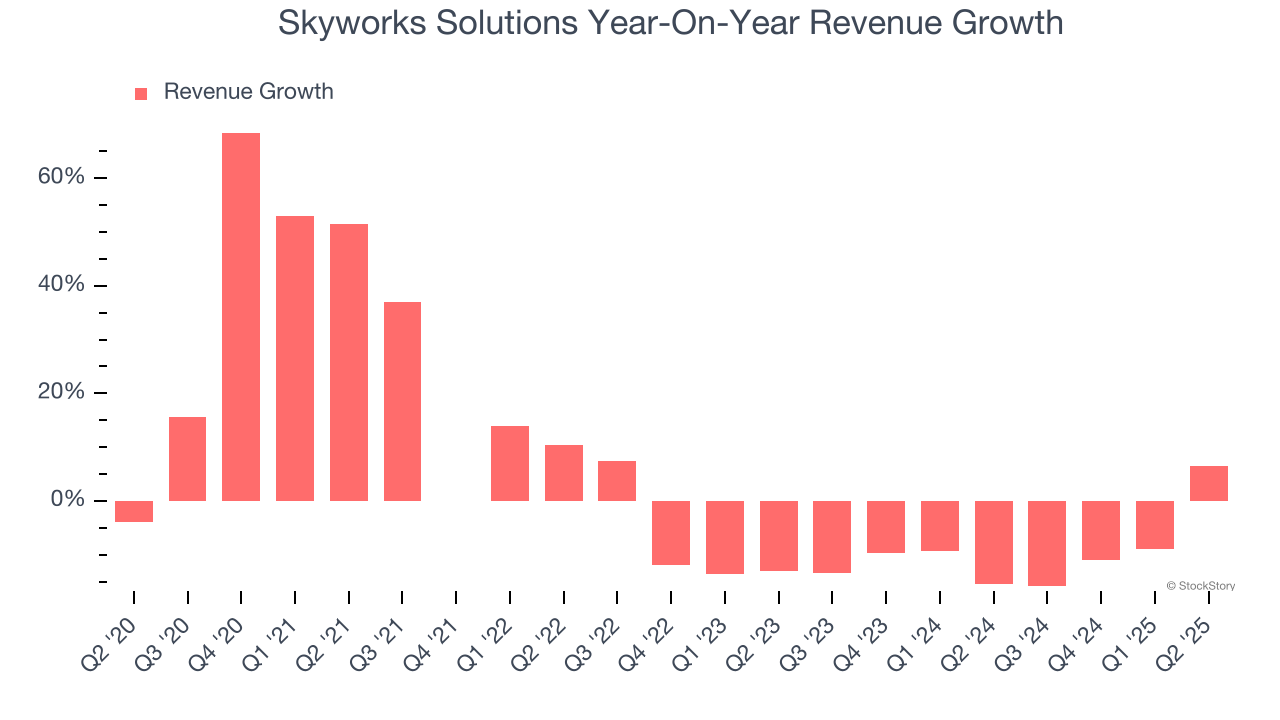

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a stretched historical view may miss new demand cycles or industry trends like AI. Skyworks Solutions’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 10.1% annually.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Skyworks Solutions’s revenue to drop by 7.8%. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

3. Shrinking Operating Margin

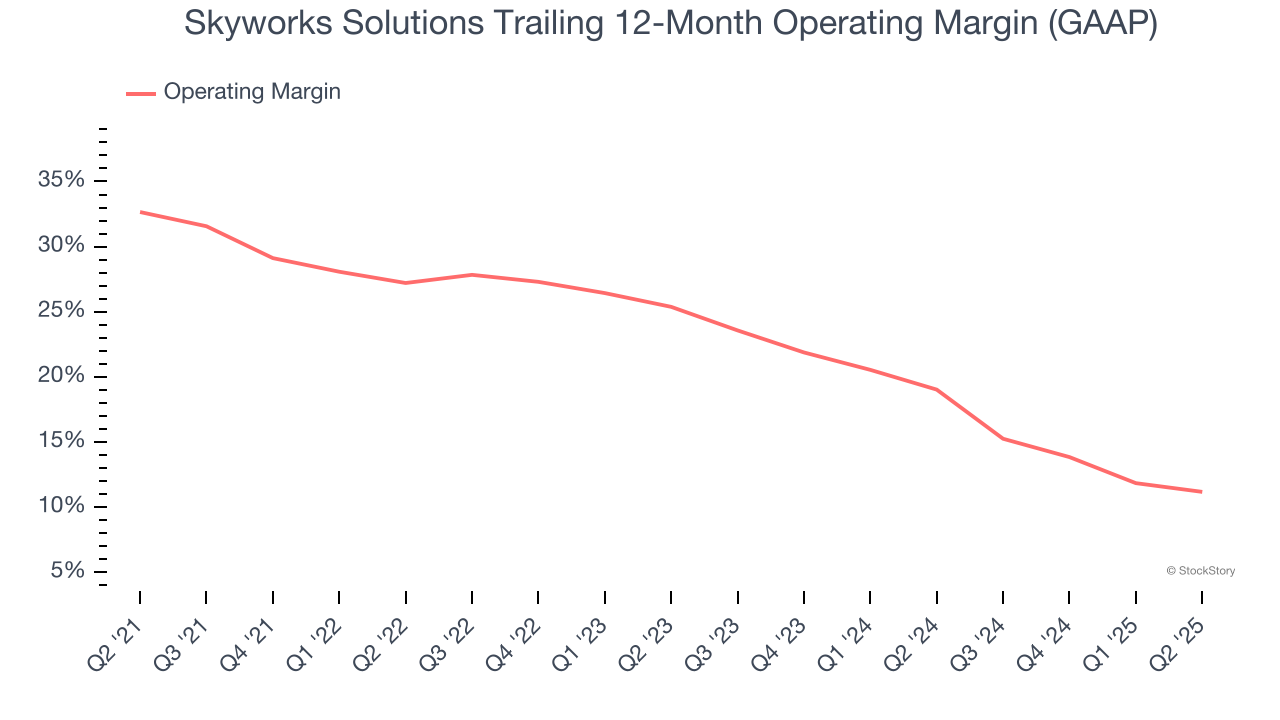

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Looking at the trend in its profitability, Skyworks Solutions’s operating margin decreased by 21.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 11.2%.

Final Judgment

Skyworks Solutions doesn’t pass our quality test. That said, the stock currently trades at 16.8× forward P/E (or $73 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. We’d recommend looking at the Amazon and PayPal of Latin America.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.