As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the specialized technology industry, including Cognex (NASDAQ:CGNX) and its peers.

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

The 8 specialized technology stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.1% while next quarter’s revenue guidance was 1.5% below.

Thankfully, share prices of the companies have been resilient as they are up 8.4% on average since the latest earnings results.

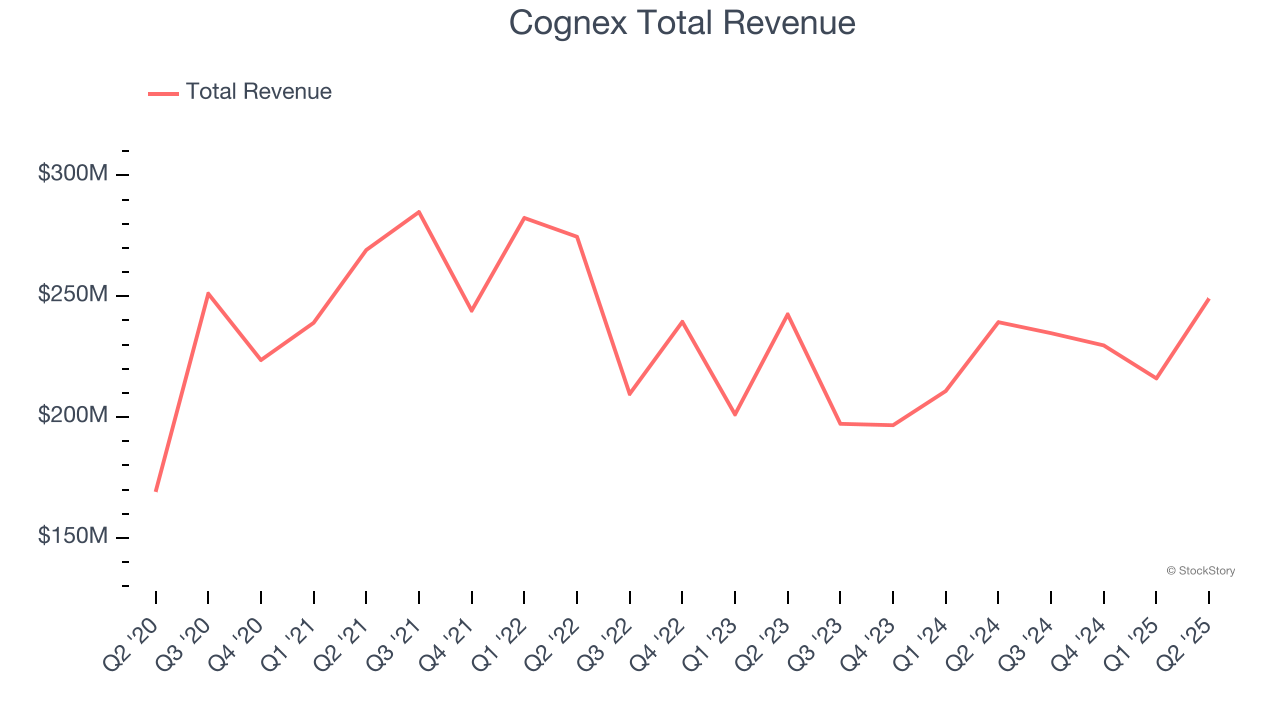

Cognex (NASDAQ:CGNX)

Founded in 1981 when computer vision was in its infancy, Cognex (NASDAQ:CGNX) develops machine vision systems and software that help manufacturers and logistics companies automate quality inspection and tracking of products.

Cognex reported revenues of $249.1 million, up 4.1% year on year. This print exceeded analysts’ expectations by 1.3%. Overall, it was a satisfactory quarter for the company with revenue guidance for next quarter exceeding analysts’ expectations but a significant miss of analysts’ full-year EPS guidance estimates.

Interestingly, the stock is up 37.4% since reporting and currently trades at $46.38.

Is now the time to buy Cognex? Access our full analysis of the earnings results here, it’s free for active Edge members.

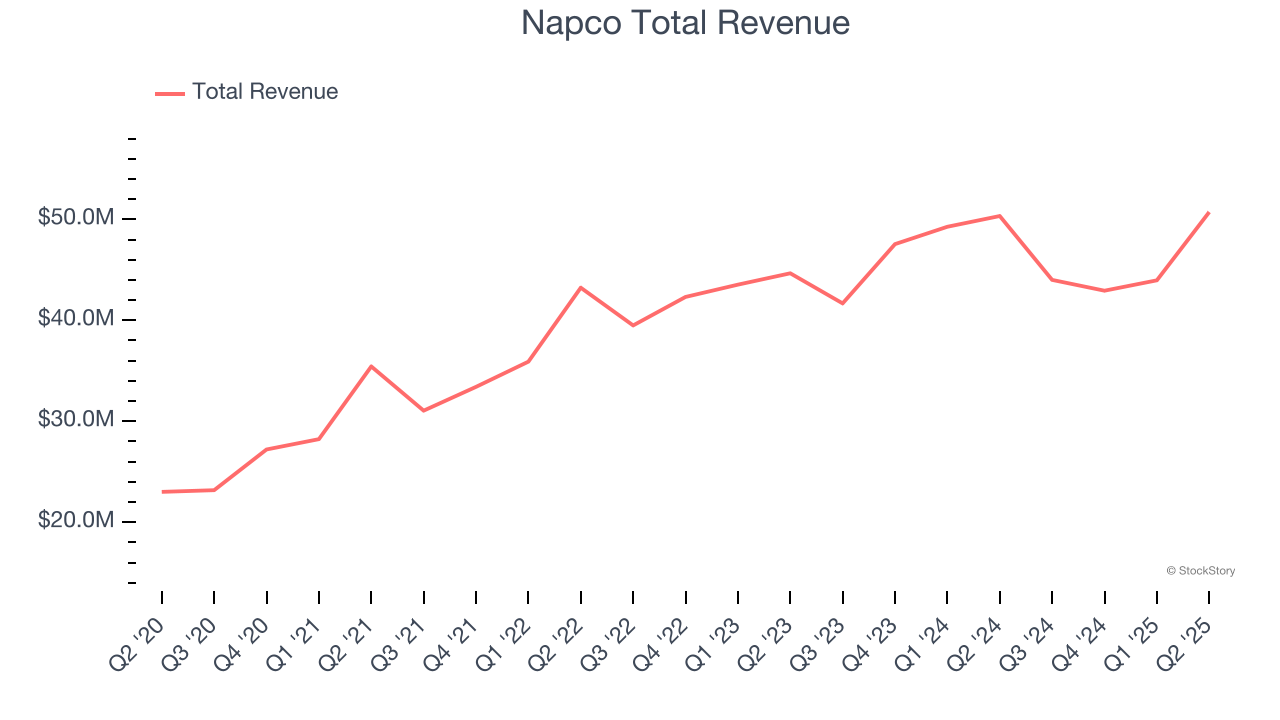

Best Q2: Napco (NASDAQ:NSSC)

Protecting everything from schools to government facilities since 1969, Napco Security Technologies (NASDAQ:NSSC) manufactures electronic security devices, access control systems, and communication services for intrusion and fire alarm systems.

Napco reported revenues of $50.72 million, flat year on year, outperforming analysts’ expectations by 14.1%. The business had an incredible quarter with a beat of analysts’ EPS and revenue estimates.

Napco scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 36.5% since reporting. It currently trades at $43.26.

Is now the time to buy Napco? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: PAR Technology (NYSE:PAR)

Originally founded in 1968 as a defense contractor for the U.S. government, PAR Technology (NYSE:PAR) provides cloud-based software, payment processing, and hardware solutions that help restaurants manage everything from point-of-sale to customer loyalty programs.

PAR Technology reported revenues of $112.4 million, up 43.8% year on year, exceeding analysts’ expectations by 1.3%. Still, it was a slower quarter as it posted a significant miss of analysts’ ARR estimates.

As expected, the stock is down 40.4% since the results and currently trades at $34.51.

Read our full analysis of PAR Technology’s results here.

Crane NXT (NYSE:CXT)

Born from a corporate transformation completed in 2023, Crane NXT (NYSE:CXT) provides specialized technology solutions for payment processing, banknote security, and authentication systems for financial institutions and businesses.

Crane NXT reported revenues of $404.4 million, up 9.1% year on year. This number topped analysts’ expectations by 5.9%. It was a very strong quarter as it also put up an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ revenue estimates.

The stock is up 18.6% since reporting and currently trades at $66.77.

Read our full, actionable report on Crane NXT here, it’s free for active Edge members.

Zebra (NASDAQ:ZBRA)

Taking its name from the black and white stripes of barcodes, Zebra Technologies (NASDAQ:ZBRA) provides barcode scanners, mobile computers, RFID systems, and other data capture technologies that help businesses track assets and optimize operations.

Zebra reported revenues of $1.29 billion, up 6.2% year on year. This print was in line with analysts’ expectations. Overall, it was a very strong quarter as it also produced an impressive beat of analysts’ EPS guidance for next quarter estimates and a solid beat of analysts’ full-year EPS guidance estimates.

Zebra had the weakest performance against analyst estimates among its peers. The stock is down 14.1% since reporting and currently trades at $294.

Read our full, actionable report on Zebra here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.